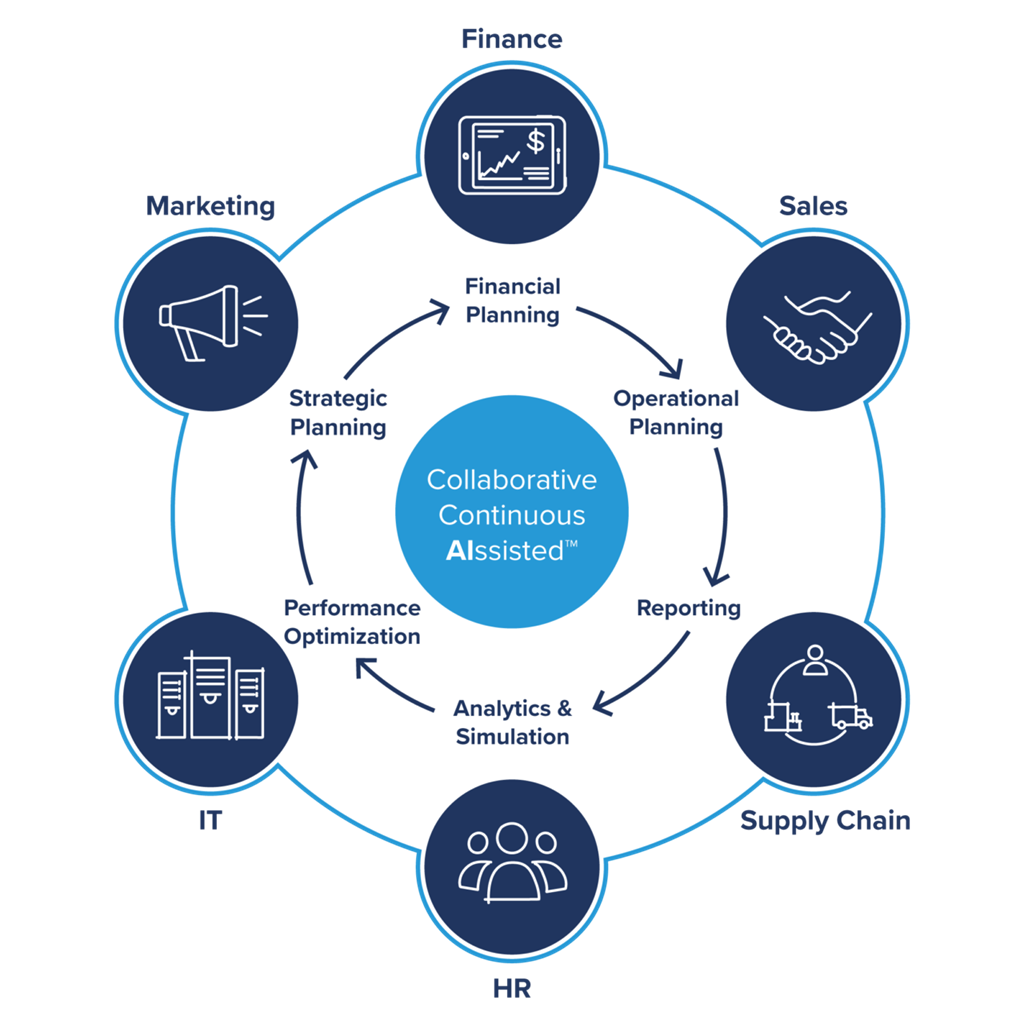

Establishing an efficient Financial Planning and Analysis (FP&A) process that connects data from multiple sources and lets you effectively plan, collaborate and leverage AI, is a key strategic foundation service solution every business must have. It will also assess your optimal capital structure and levels of affordable debt.

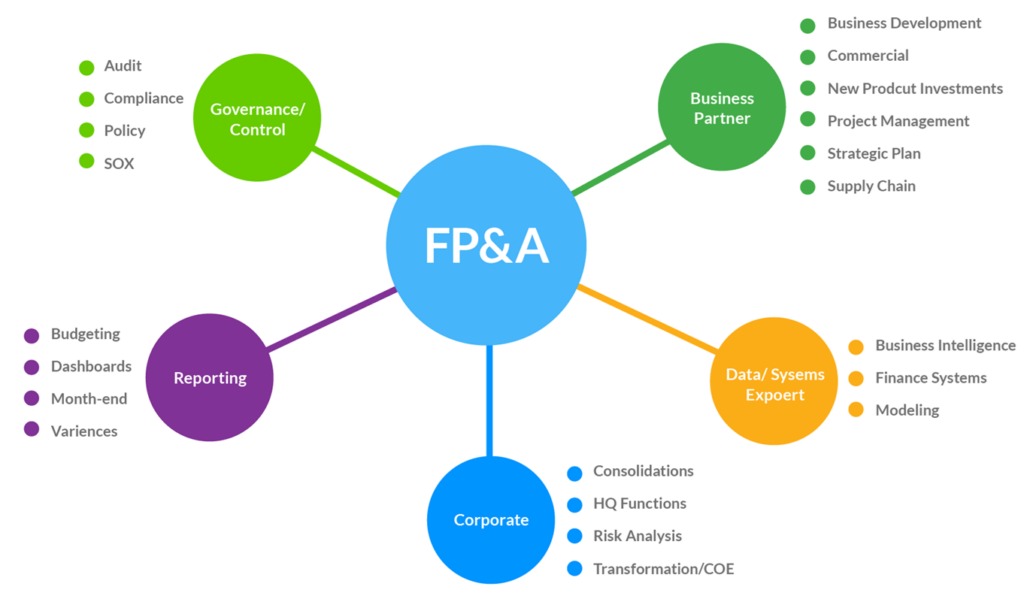

Large enterprises, SMBs, or startups, all need a best-practice FP&A function that is lean and efficient but can support the growing use cases needed to scale and enable services across all business functions. Such best-practice FP&A delivers Revenue Planning, Headcount planning, Budgeting and Forecasting, Scenario Planning, Investor Reporting, and Financial Performance & Reporting. i.e. Accounting Statements (Profit & Loss, Balance Sheet, Cash flows).

A complete FP&A capability needs to go beyond data and software and recognise its service function to unlock value generation across the entire business. Its value is as good as the quality of the data, drivers and assumptions.

While Excel provides simplicity, and familiarity and is low cost, it can quickly turn into a governance nightmare and slow manual processes, with errors and limitations. At the other extreme are complex ERP systems, which may or may no suit your business. Even if you do have an ERP you may well find your FP&A is lacking best practice process, or proving too complex or costly to keep up with growing use cases.

Preferring, simplicity, and cost-effectiveness yet being powerful enough to enable best practice FP&A has led us to pick and partner with two modern FP&A solutions: Datarails (SMB), and Abacus (Mid-Large size).

| Datarails (SMB) | Abacus (Mid-size) |

| Datarails offers an FP&A solution that integrates and automates financial data from multiple sources while preserving Excel’s flexibility. It consolidates data, streamlines budgeting and forecasting, and provides advanced analytics and reporting in a centralized platform. This reduces manual work, improves data accuracy, and enhances decision-making capabilities for finance teams. | Abacum offers a modern comprehensive FP&A platform that centralizes financial data, streamlines budgeting and forecasting, and facilitates real-time collaboration among stakeholders. Automating planning, modelling & forecasting, enables all functions and exec teams to make faster, more informed decisions. This ultimately improves the accuracy and efficiency of all FP&A processes. |

The FP&A function faces multiple challenges in achieving best practices. This includes Standardisation and quality of financial information and lack of operational efficiency. An effective FP&A will leverage your latest trial balance and also connect data from other systems, such as ERP, CRM and Payroll, to give you one central source of truth of P&L broken down by region, customer, business function or project.