Unlike loans, grants don’t need to be paid back

Invest in your goals: innovation, training, or expansion

Access multiple funding sources in one place

Keep full control of your business and equity

Business grants are payments from the Government or private organizations to support specific business activities like training, expansion, or research and development. Unlike loans, business grants do not require repayment, and they don’t require giving away a share of the business.

Grants are generally designed to support a specific project or objective. There are a wide variety of grants available, each focused on different aspects of a business, including environmentally friendly practices, improving digital connectivity, or backing female entrepreneurs.

Different types of business grants focus on specific objectives like enhancing sustainability, job creation, or training. Direct grants provide a cash sum for a particular purpose, while resource and training grants offer resources like training, mentorship, and workshops. Tax relief schemes can also provide additional funding.

Grants can be paid as a single lump sum upfront, or as a reimbursement after the business has spent its own money, or require the business to match the value of the grant before receiving it.

Advantages include not having to repay the money, retaining full equity in the business, and the potential for synergy with other forms of finance. Securing an initial grant can also increase the chances of receiving additional awards or funding.

Disadvantages include high competition, specific eligibility requirements, time-consuming application processes, potential cash flow impacts, and the possibility of needing to match the grant funding. Grants are typically one-off awards and not a consistent source of long-term financial support.

Business grants usually have very specific eligibility criteria, such as the size of your business, where you’re based, the business sector, and what you’ll use the grant money for. Some grants are industry and location-specific.

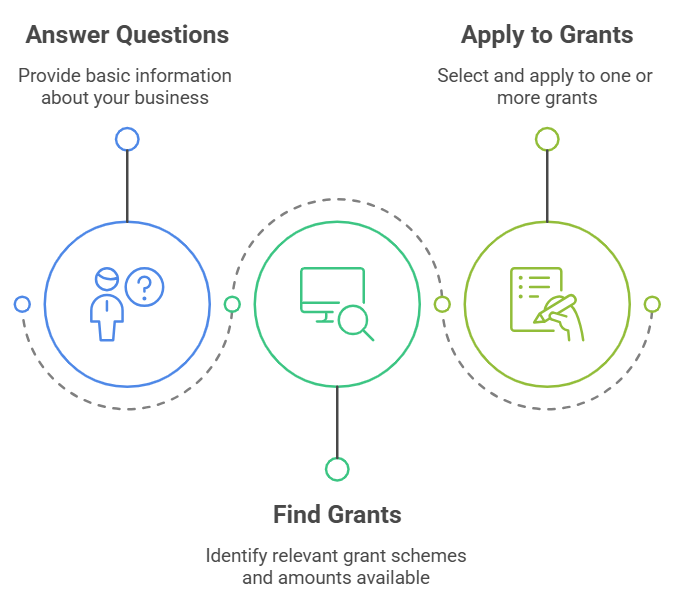

Research the grant provider, apply early, be detailed and specific, use clear language, ensure you have a comprehensive business plan, and meet the deadline. For complex grant applications, you can also engage one of our agents to assist.